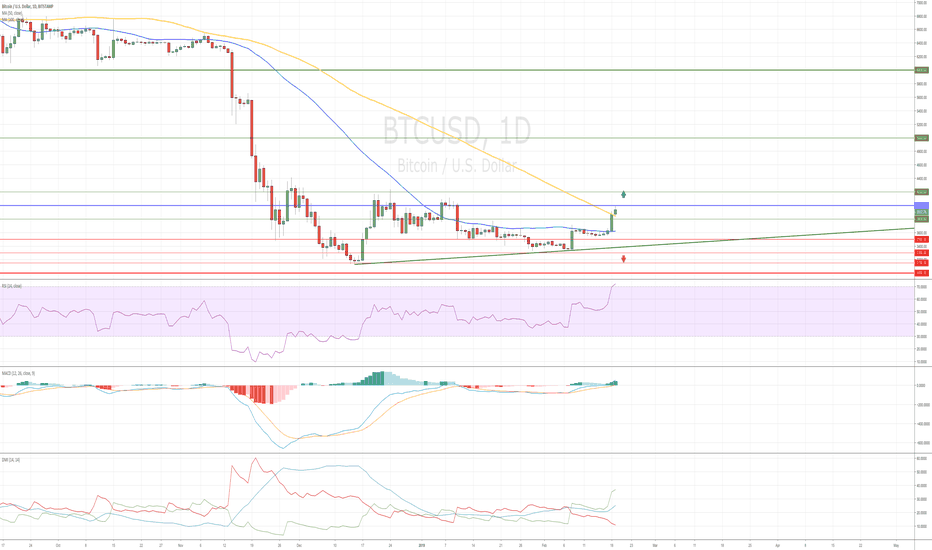

The fourth week of February has been kind to the cryptocurrency markets and to Bitcoin traders in particular. After a bear market that has extended beyond 12 months, Bitcoin traders were very happy to see a brief regression towards the $3,500 level, which was followed by a quick bounce towards $3,900 in just a few days, and culminated backtracking to $3,800. Quite a few traders were hoping to see $4,000 before February 19, but more seasoned cryptocurrency analysts warned against quick pullbacks that have become a staple of a sideways market.

According to a news story published by British news magazine The Week, a fundamental development not directly related to Bitcoin ended up boosting other major digital currencies such as Ripple and Ethereum. The news story in question was an announcement by JPMorgan Chase, a global retail banking giant that is now operating its very own private cryptocurrency token running on an Ethereum blockchain. The purpose of JPM Coin is to offer JPMorgan Chase clients an alternative to the SWIFT network for international wire transfers, and this happens to be something that executives of Ripple Labs, developers of the XRP token, have been working on for more than a year.

The JPM Coin announcement is significant because JPMorgan CEO Jamie Dimon has been a staunch opponent of Bitcoin and other tokens, but it is safe to assume that he saw the writing on the wall and decided that the time was right to develop a blockchain project. When a major player such as JPMorgan jumps on the cryptocurrency bandwagon, investors take note and traders move very quickly, hence Bitcoin’s recent push towards $4,000. Naturally, the original Ethereum token and XRP benefited from JPM Coin news because of their inherent ties.

Naturally, the brief rally caused by JPMorgan has prompted Bitcoin enthusiasts to ponder whether this is it, the moment everyone has been waiting for, the elusive rally that failed to materialize in 2018. Trading platform operators such as eToro believe that a rally is possible as long as BTC/USD is able to remain at current levels over the next two weeks, but things are unlikely to unfold as they did in 2017. If anything, traders should be cautious because quick profit taking has become a common strategy in the Bitcoin world. XRP and ETH are showing more stability, but BTC remains a volatile financial instrument despite the arrival of JPM Coin.